UK ETS

The United Kingdom’s Emissions Trading Scheme (UK ETS)

Coverage

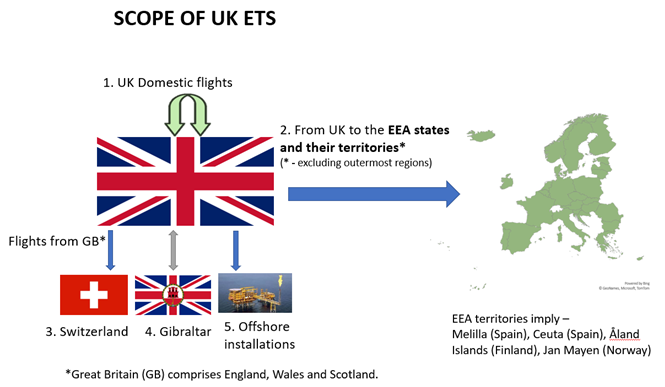

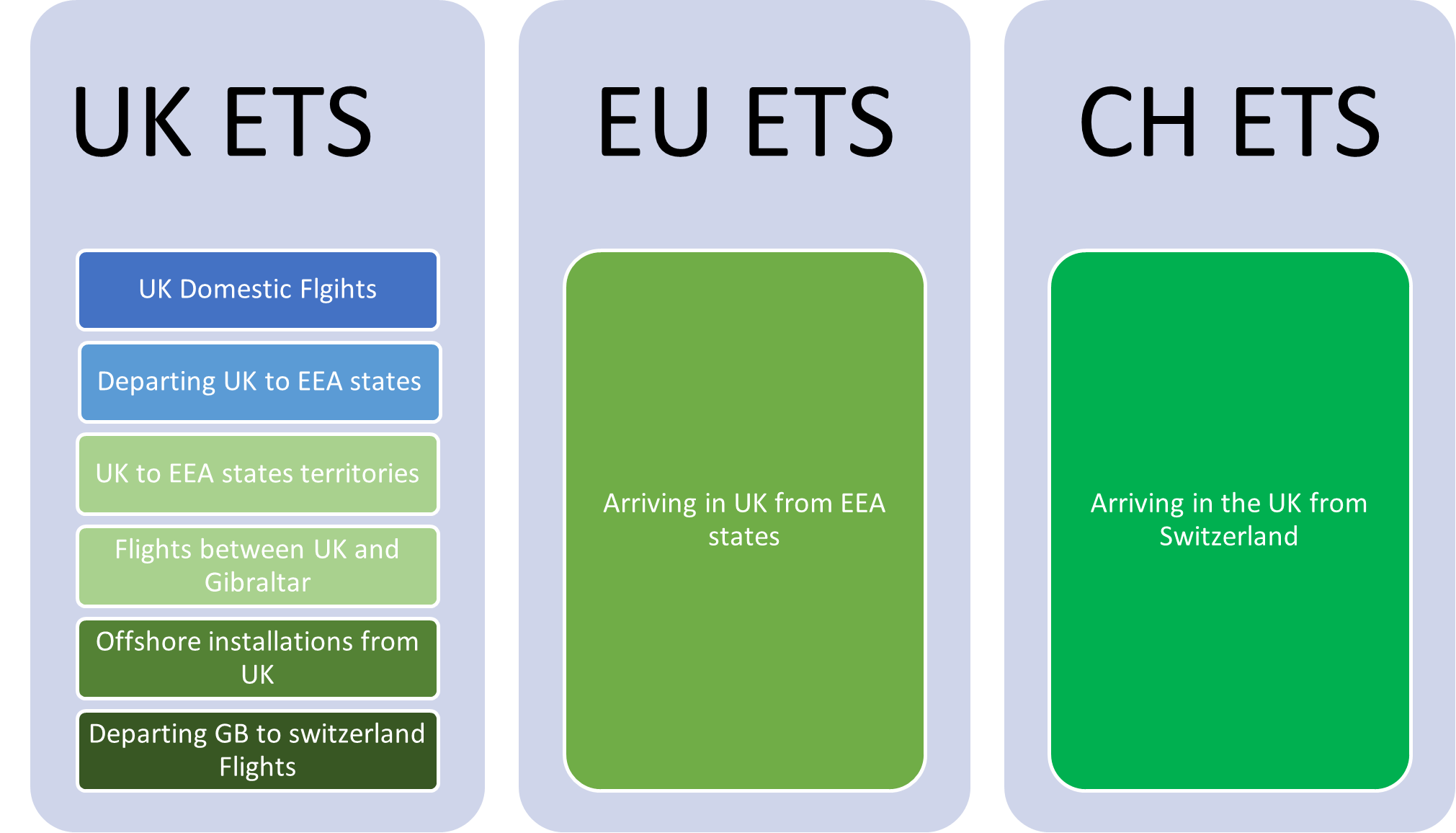

The UK Government and Devolved Administrations have agreed on the ambition to implement the below-proposed route option presented in their UK ETS public consultation. Therefore, the UK ETS would impose surrendering obligations on the following routes from day one:

- UK domestic flights

- Flights departing the UK to territories of EEA member states, would be included in the scope of UK ETS. These include Ceuta and Melilla (Spain), the Åland Islands (Finland) and Jan Mayen (Norway).

- Flights between the UK and Gibraltar would still be subject to surrendering obligations but now under the UK ETS, just as they were covered by the EU ETS prior to Brexit.

- Flights to offshore installations would also be included in a UK ETS.

- Flights departing from Great Britain to Switzerland. (Note: Great Britain comprises England, Wales, and Scotland.)

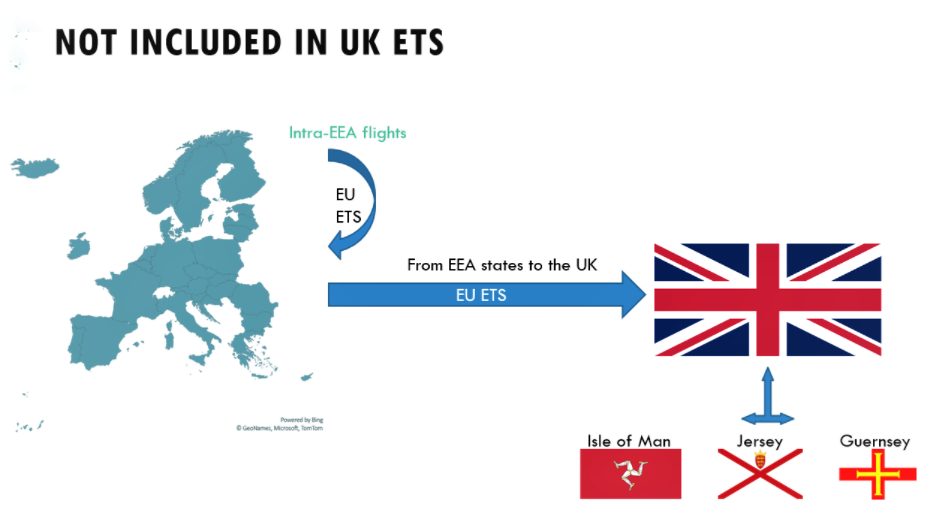

On the other hand, the UK ETS would not cover/ require the reporting of flights to or from the three crown dependencies of the Isle of Man and the Bailiwicks of Jersey and Guernsey. On the same note, it would also not cover the flights to or from the nine EU outermost regions.

Not included in the UK ETS - Aviation Activity:

Monitoring Reporting and Verification

The compliance timeframes under the UK ETS will be the same as that under the EU ETS. A representative from the Environment Agency of the UK government confirmed that a new emissions monitoring plan would be required for all operators reporting under the UK ETS. The operators will have the option to use the same two methods permitted under the EU ETS, additionally, a reconciliation was reached between the UK ETS and CORSIA, which allows operators the ability to use any of the five methods allowed in CORSIA. The UK Authority continued to use the ETSWAP portal until the end of 2023. From 2024 onwards, and for the 2023 monitoring period, a new system, Manage your UK Emissions Trading Scheme Reporting Service (METS) will be used.

Emissions Monitoring Plan (EMP)

An Emissions Monitoring Plan (EMP) is required to comply with the UK Emissions Trading Scheme (UK ETS). An aircraft operator does not need to apply for an EMP if they are already regulated by the UK under the EU ETS. Aircraft operators not regulated by the UK for EU ETS will need to apply for a new EMP, and the UK ETS regulator will depend on where the AO is registered or resides. Details for both of these scenarios are included below.

If the AO is currently regulated by the UK for the EU ETS:

The regulator will remain the same and will issue a UK ETS EMP on substantially the same terms as your EU ETS EMP after 1 January 2021. The regulator will contact the AO regarding the UK ETS EMP.

The AO will continue to have access to their account in the regulator’s online application and the Emissions Trading System Workflow Automation Program (ETSWAP) until the end of 2023.

If the Aircraft Operator (AO) is not currently regulated by the UK under the EU ETS:

The AO must contact their regulator and apply for an EMP within 6 weeks of becoming an aircraft operator. If the AO has missed this deadline, they must contact their regulator as soon as possible otherwise it may result in significant civil penalties.

If you are unsure of who your regulator is or want to apply for an EMP, please use the following link for the official UK government page.

Duration and timeline

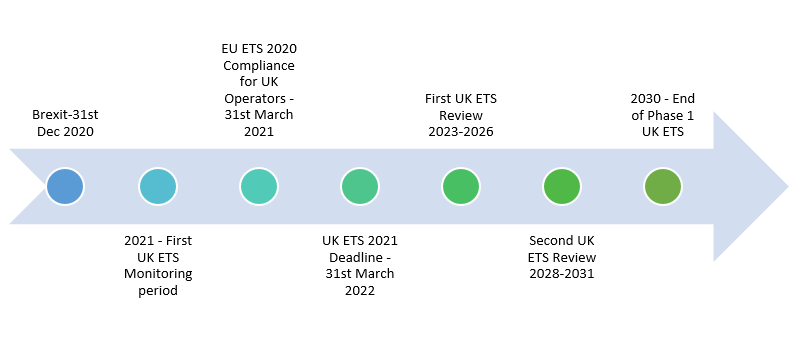

Figure 1 - Overview of the planned implementation

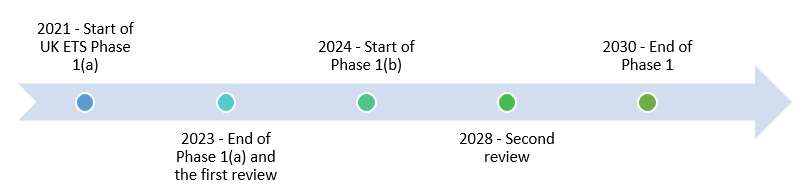

The UK government has decided to implement a UK ETS with Phase I running from 2021 to 2030 which matches the duration set for the EU ETS Phase IV. With regards to the review of the UK ETS, it was deemed sufficient to have two full system reviews within Phase 1. These reviews are exactly in line with the EU ETS Phase IV reviews and the Paris Agreement Global Stocktake efforts.

- The first whole-system review of the UK ETS is to be conducted from 2023 to assess performance during the first half of the phase (2021-2025) with any necessary changes to design features implemented by 2026.

- The second whole-system review will be from 2028 onwards to assess performance across all of Phase I (2021-2030) with any update to the UK ETS rules implemented for 2031 (Phase II).

Figure 2 - Planned Phases

The whole system reviews will include targeted reviews on certain elements of the UK ETS policy. The reviews will aim to discuss changes required to align with international aviation decarbonization efforts through CORSIA. This is in addition to reviewing necessary changes which may result from a linking with EU ETS. (Pg. 28 (administrators, June 2020))

Compliance Deadlines

The United Kingdom government has confirmed the following compliance deadlines for the implementation of the UK ETS.

| Action | Time |

| Monitor aviation emissions in line with the EMP | Between 1 January and 31 December in year n |

| Start preparing the annual emissions report (with time for verification, if required) | Towards the end of the year n |

| Submit the annual emissions report via ETSWAP | By 31 March of year n+1 |

| Surrender allowances equal to your reportable emissions | By 30 April of the year n+1 |

| Improvement report | By 30 June of the year n+1 |

(‘n’ being a monitoring period which an aircraft operator is reporting for)

For example, for the first monitoring year, 2021, operators shall monitor their aviation emissions in line with the EMP from 1 January to 31 December 2021. Towards the end of 2021, operators shall start preparing the annual emissions report (and engage with a verifier, if needed). The 2021 verified (if needed) annual emissions report will need to be submitted via ETSWAP by 31 March 2022, and the allowances equal to the reportable emissions will need to be surrendered by 30 April 2022.

The deadline for the application to receive free allowances had been set for the 31st of March 2021 as per the United Kingdom government, no more free allowances were issued after this date.

From 1 January 2023, the scope of UK ETS expanded to include flights (other than excluded flights) departing from Great Britain (GB) and arriving in Switzerland (CH) (GB-CH flights). As a result, a person that has historical aviation activity including GB-CH flights may apply for a UK ETS Aviation Free Allocation Entitlement (AFAE) using verified tonne-kilometre data (verified TKM data) from 2010 and/or 2014. The free allowances will be determined and published by the authority by 30 June 2023.

Offsets

The UK Government and Devolved Administrations remain of the view that offsets should not be permitted in the UK ETS right from the outset. (Pg. 37 (administrators, June 2020))

The UK government is very clear on its position of introducing offsets right at the beginning of the UK ETS. They have expressed concerns on how offsets would potentially create an over-supply of allowances and therefore undermine the cap and trade mechanism reducing their ability to achieve the environmental targets. Nonetheless, the UK government has left the door open and is willing to review and develop standards or tests which would be necessary for the acceptance of offsets in a UK ETS. This implies that the UK ETS would not be compatible with the CORSIA and that the operators would have to report on CORSIA separately. The UK government plans to review the inclusions of offsets and CORSIA during the first full review.

The UK Government and Devolved Administrations remain of the view that offsets should not be permitted in the UK ETS right from the outset. (Pg. 37 (administrators, June 2020))

The UK government is very clear on its position of introducing offsets right at the beginning of the UK ETS. They have expressed concerns on how offsets would potentially create an over-supply of allowances and therefore undermine the cap and trade mechanism reducing their ability to achieve the environmental targets. Nonetheless, the UK government has left the door open and is willing to review and develop standards or tests which would be necessary for the acceptance of offsets in a UK ETS. This implies that the UK ETS would not be compatible with the CORSIA and that the operators would have to report on CORSIA separately. The UK government plans to review the inclusions of offsets and CORSIA during the first full review.

195. However, the UK Government and Devolved Administrations are open to reviewing the usage of offsets in future, especially in deciding how best to implement CORSIA alongside a UK ETS.

196. We will review the usage of offsets in a UK ETS as part of the review process set out in the Phase and Review sections. Once there is more certainty on the development and implementation of global decarbonization mechanisms such as CORSIA and the Paris Agreement, any review of this area will also consider how a UK ETS can best align with them. (administrators, June 2020)

196. We will review the usage of offsets in a UK ETS as part of the review process set out in the Phase and Review sections. Once there is more certainty on the development and implementation of global decarbonization mechanisms such as CORSIA and the Paris Agreement, any review of this area will also consider how a UK ETS can best align with them. (administrators, June 2020)

On a similar note, they have also outlawed GGR (greenhouse gas reduction) technologies but have reportedly invested millions to research and monitor the maturity of said technologies for a potential future inclusion in the UK ETS.

The EU ETS works on a “cap and trade” basis, where there is a cap on all greenhouse gas emissions from covered installations and aviation operators. The cap is reduced over time to ensure that total emissions fall. Each year, operators must surrender sufficient allowances to cover their greenhouse gas emissions. Allowances are awarded free to participants considered at risk of “carbon leakage” (where, due to the cost of emission allowances, industry relocates to regions outside the EU with a lower carbon price). Allowances are also auctioned directly by Member States and traded on the secondary market between operators and other market participants.

The proposed UK ETS will to a great extent follow the footsteps of the existing EU ETS framework, with variations implemented only where the UK government deems the EU ETS framework to be unsuitable for the UK's clean growth strategy or to be misaligned with the UK’s 2050 Net zero goal. From a design perspective, the UK government decided that the UK ETS should be designed at all levels to be at least as ambitious as the EU ETS.

In addition, the UK ETS is a new emissions market, whereby any uncertainties around how the market will respond will need to be considered when setting the cap.

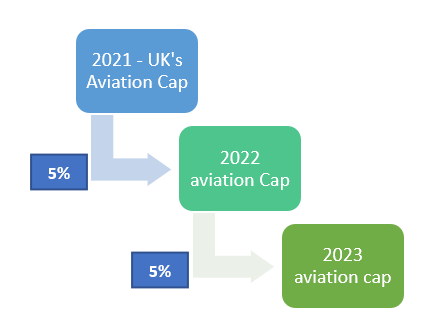

To balance these objectives, the cap for a UK ETS will initially be set at 5% below the UK’s expected notional share of the EU ETS cap for Phase IV of the EU ETS. Based on the proposed design scope, this equates to around 156 million allowances in 2021. These cap figures include our proposed aviation scope (administrators, June 2020)

Cap and Trajectory

The UK Government and devolved administrators have decided that the aviation component of the UK ETS cap should be at least as ambitious as the UK’s expected notional share of the EU ETS aviation cap for Phase IV. Furthermore, they have also stated that it would be a single cap for all participating sectors in the UK ETS. The UK government recognizes that not all sectors would be able to abate emissions at the same rate and hence wish to facilitate abatement where it is most cost-effective.

This will help ensure that decarbonization can first happen where it is most cost-effective to do so. We will be reviewing the abatement potential for different UK ETS participating sectors, taking efficiency gains into account for future UK ETS policy design. (Pg. 56) (administrators, June 2020)

This initial cap would then be reduced annually by 4.2 million allowances to keep in line with the goal of having a UK ETS cap which is 5% below the expected notional share of the UK in the Phase IV EU ETS cap. Furthermore, The UK Government and Devolved Administrations have decided to mirror the EU ETS in certain aspects where they deemed that there would be no negative repercussions to the UK’s 2050 Net Zero goal. All allowances in the system will be interchangeable between participating sectors just as they are in Phase IV of the EU ETS. This is also subject to review considering the integration of the global offsetting scheme, CORSIA. The UK ETS will also mirror the EU ETS in freedom of purchasing allowances between sectors. In Phase III of the EU ETS, aircraft operators could purchase stationary allowances; in Phase IV, the reverse will also be true as stationary operators will be able to buy aviation allowances.

Allocation Methodology

The UK Government has proposed to keep the “day one UK ETS” free allocation approach which mirrors the EU ETS’s allocation methodology for Phase IV. This implies that the operators will receive free allowances on day one based on their historical activity on the routes covered under the UK ETS. The free allowances received by operators would then reduce annually by 5%, which is the same percentage by which the UK’s overall emissions cap will reduce. The UK Government has also stated that it will review the free allowances allocation methodology in the first review with changes likely to be implemented on Phase 1(b).

Free Allowances

Free allocations were allotted to qualifying aircraft operators based on their historical aviation activity in 2021. Based on the Great Britain and Switzerland linkage, a new free allocation was published by the authority on 30 June 2023.

Registry

Similar to the EU ETS registry, a UK Emissions Trading Registry has been developed for the UK ETS. Aircraft operators are required to have an Aircraft Operator Holding Account (AOHA) in the UK ETS Registry to acquire and surrender allowances in line with their obligations.

Prior to the opening of an AOHA, the operator is required to have an Emissions monitoring plan (EMP). Once the EMP has been issued, the regulator of the aircraft operator will instruct the Registry Administrator to open an AOHA for the operator in question. The operator will then be contacted by the Registry Administrator and asked to provide details of a primary contact (who is authorized to give instructions to the Registry Administrator on behalf of the operator), and also to nominate authorized representatives to operate the AOHA.

As such, the process of opening a Registry account can take up to 2 months (and longer in some cases) and entails the same amount of scrutiny as with the opening of a bank account. It is advisable that the EMP procedure followed by the registry account creation procedure be started at the earliest.

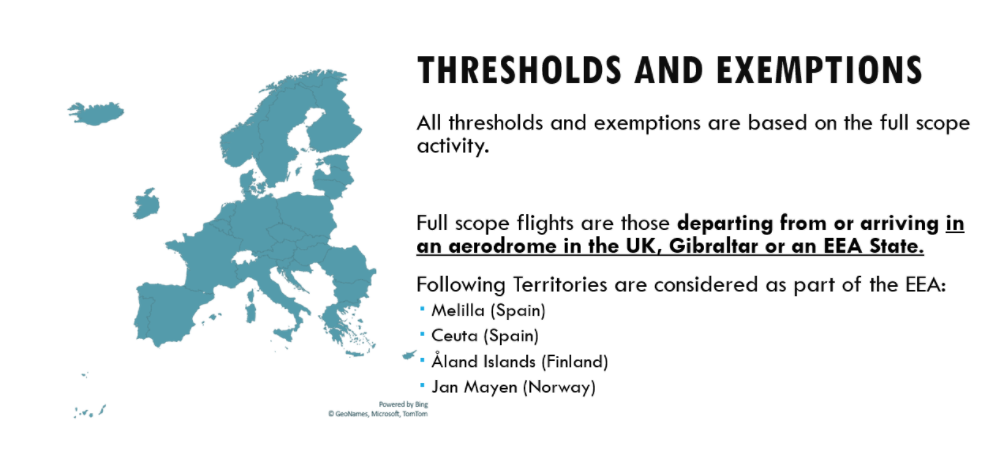

Thresholds and exemptions

In all scenarios (linking or no linking), the thresholds for commercial and non-commercial aircraft operators would be the same as those in the current EU ETS.

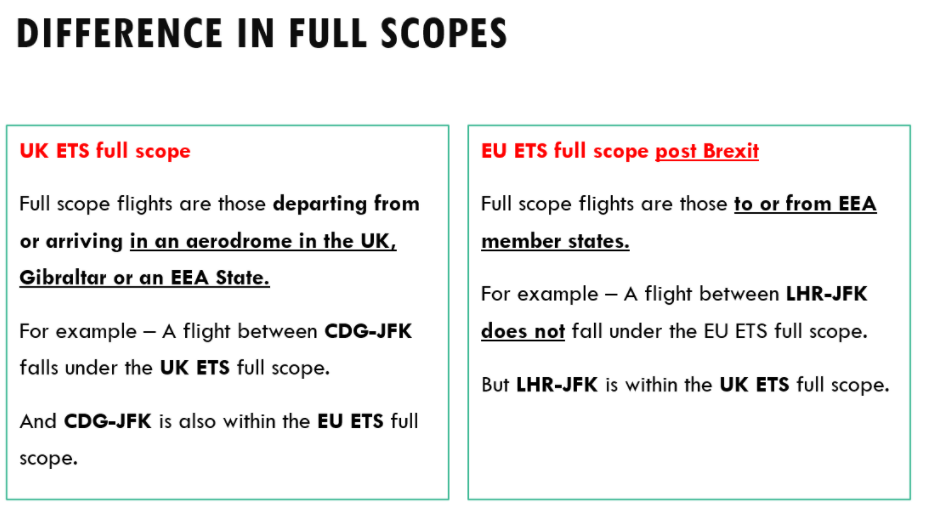

Under UK ETS, full scope activity is defined as all flights that either arrive or depart from an aerodrome within the UK, Gibraltar or European Economic Area, regardless of where the aircraft operator is registered.

Similarly, the reduced scope would refer solely to domestic UK flights and flights departing from the UK to EEA states and their territories as explained in the coverage section above.

All thresholds will be based upon the full scope activity while all surrendering obligations would be calculated based on the UK ETS reduced scope.

Flights operated by fixed wing and rotary wing aircraft would be included unless the MTOW (maximum take-off mass) is below 5700 Kg. Helicopters are subject to MRV under UK ETS just like they were under EU ETS.

Commercial aircraft operators would not be subject to any obligations if they meet either of the following criteria:

• Operate fewer than 243 flights per period for three consecutive four-month periods based on full scope activity. The four-month periods are: January to April, May to August, September to December,

• Operate flights with total annual emissions of less than 10,000 tonnes of CO2 per year based on full scope activity.

Non-commercial aircraft operators would not be subject to any obligations if they operate flights with total annual emissions lower than 1,000 tonnes of CO2 per year based on full scope activity.

Other exemptions based on the type of flight

This initial cap would then be reduced annually by 4.2 million allowances to keep in line with the goal of having a UK ETS cap which is 5% below the expected notional share of the UK in the Phase IV EU ETS cap. Furthermore, The UK Government and Devolved Administrations have decided to mirror the EU ETS in certain aspects where they deemed that there would be no negative repercussions to the UK’s 2050 Net Zero goal. All allowances in the system will be interchangeable between participating sectors just as they are in Phase IV of the EU ETS. This is also subject to review considering the integration of the global offsetting scheme, CORSIA. The UK ETS will also mirror the EU ETS in freedom of purchasing allowances between sectors. In Phase III of the EU ETS, aircraft operators could purchase stationary allowances; in Phase IV, the reverse will also be true as stationary operators will be able to buy aviation allowances.

Allocation Methodology

The UK Government has proposed to keep the “day one UK ETS” free allocation approach which mirrors the EU ETS’s allocation methodology for Phase IV. This implies that the operators will receive free allowances on day one based on their historical activity on the routes covered under the UK ETS. The free allowances received by operators would then reduce annually by 5%, which is the same percentage by which the UK’s overall emissions cap will reduce. The UK Government has also stated that it will review the free allowances allocation methodology in the first review with changes likely to be implemented on Phase 1(b).

Free Allowances

Free allocations were allotted to qualifying aircraft operators based on their historical aviation activity in 2021. Based on the Great Britain and Switzerland linkage, a new free allocation was published by the authority on 30 June 2023.

Registry

Similar to the EU ETS registry, a UK Emissions Trading Registry has been developed for the UK ETS. Aircraft operators are required to have an Aircraft Operator Holding Account (AOHA) in the UK ETS Registry to acquire and surrender allowances in line with their obligations.

Prior to the opening of an AOHA, the operator is required to have an Emissions monitoring plan (EMP). Once the EMP has been issued, the regulator of the aircraft operator will instruct the Registry Administrator to open an AOHA for the operator in question. The operator will then be contacted by the Registry Administrator and asked to provide details of a primary contact (who is authorized to give instructions to the Registry Administrator on behalf of the operator), and also to nominate authorized representatives to operate the AOHA.

As such, the process of opening a Registry account can take up to 2 months (and longer in some cases) and entails the same amount of scrutiny as with the opening of a bank account. It is advisable that the EMP procedure followed by the registry account creation procedure be started at the earliest.

Thresholds and exemptions

In all scenarios (linking or no linking), the thresholds for commercial and non-commercial aircraft operators would be the same as those in the current EU ETS.

Under UK ETS, full scope activity is defined as all flights that either arrive or depart from an aerodrome within the UK, Gibraltar or European Economic Area, regardless of where the aircraft operator is registered.

Similarly, the reduced scope would refer solely to domestic UK flights and flights departing from the UK to EEA states and their territories as explained in the coverage section above.

All thresholds will be based upon the full scope activity while all surrendering obligations would be calculated based on the UK ETS reduced scope.

Flights operated by fixed wing and rotary wing aircraft would be included unless the MTOW (maximum take-off mass) is below 5700 Kg. Helicopters are subject to MRV under UK ETS just like they were under EU ETS.

Commercial aircraft operators would not be subject to any obligations if they meet either of the following criteria:

• Operate fewer than 243 flights per period for three consecutive four-month periods based on full scope activity. The four-month periods are: January to April, May to August, September to December,

• Operate flights with total annual emissions of less than 10,000 tonnes of CO2 per year based on full scope activity.

Non-commercial aircraft operators would not be subject to any obligations if they operate flights with total annual emissions lower than 1,000 tonnes of CO2 per year based on full scope activity.

Other exemptions based on the type of flight

- The transport, on an official mission, of a reigning Monarch and his/her immediate family, Heads of State, Heads of Government and Government Ministers of a country other than the UK.

- Military flights (by military aircraft), police, customs.

- Search and rescue flights, fire-fighting flights, humanitarian flights and emergency medical service flights

- VFR flights. Flights performed solely under visual flight rules as defined by the Chicago convention.

- Circular flights

- Training flights, exclusively for obtaining a license or a type rating for the crew.

- Scientific research flights or flights carried out for testing or certifying the aircraft or equipment.

Small Emitters

The criteria to classify as a small emitter under the UK ETS are the same as it is under the EU ETS. The UK government has committed to reviewing the thresholds associated with the small emitter classification in the first year of UK ETS itself. Any changes if decided upon will be implemented by the start of Phase 1(b).

If an operator is classed as a small emitter, they would be eligible for a simplified monitoring approach that involves the use of EUROCONTROL’s Small Emitters Tool (SET).

Listed below are the two criteria. An operator fulfilling either one would be classed as a small emitter.

The criteria to classify as a small emitter under the UK ETS are the same as it is under the EU ETS. The UK government has committed to reviewing the thresholds associated with the small emitter classification in the first year of UK ETS itself. Any changes if decided upon will be implemented by the start of Phase 1(b).

If an operator is classed as a small emitter, they would be eligible for a simplified monitoring approach that involves the use of EUROCONTROL’s Small Emitters Tool (SET).

Listed below are the two criteria. An operator fulfilling either one would be classed as a small emitter.

- Operate flights with total annual emissions of less than 25,000 tonnes of CO2 based on full scope activity,

- Or, operate fewer than 243 flights per period for three consecutive four-month periods based on full scope activity.

Fulfilling either of the below-listed criteria makes operators eligible to use the EUROCONTROL's ETS Support Facility

- Operate flights with total annual emissions of less than 25,000 tonnes of CO2 based on full scope activity,

- Or, operate flights with total annual emissions of less than 3,000 tonnes of CO2 based on activity within the scope of UK ETS.

Linking of UK ETS and Swiss ETS

On 18 November 2022 at the COP27 in Sharm-el-Shekh, the United Kingdom and Switzerland signed a memorandum of understanding (MOU) on the inclusion of flights between the countries in their Emissions Trading Schemes (ETS).

From 1 January 2023:

- The scope of UK ETS is expanded to include flights (other than excluded flights) departing from Great Britain and arriving in Switzerland.

- The scope of Swiss ETS is expanded to include flights (other than excluded flights) departing from Switzerland and arriving in the UK

Conclusion

The UK ETS is greatly inspired by the structure and policies already implemented in the EU ETS and will most probably stay so. That being said, the UK government and the devolved administrations have promised that UK ETS will support and evolve in line with their goals. The UK ETS is building on the rich legacy of the EU ETS to achieve the 2050 net zero goal. It is a good example for other countries to also set up their own emissions trading schemes to account for all types of emissions that they generate.

Bibliography

Administrators, U. G. (June 2020). The future of UK carbon pricing. UK Government.

Enquiry mail to UK Environmental Agency

> UK ETS FAQs are available here

> UK ETS Summary in French (Source: DGAC)

> UK government sets out plans for including aviation in its own emissions trading scheme from next year (GreenAir Online)

> Relevant links:

https://www.gov.uk/government/publications/eu-ets-obligations-and-access-to-eu-registry-systems-in-2021/eu-ets-obligations-and-access-to-eu-registries-systems-in-2021

https://www.gov.uk/government/publications/participating-in-the-uk-ets

https://www.gov.uk/guidance/complying-with-the-uk-ets-as-an-aircraft-operator

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32020R0535&from=EN

https://ec.europa.eu/clima/policies/ets/monitoring/operators_en

https://www.gov.uk/guidance/uk-ets-apply-for-free-allocation

https://gov.uk/guidance/uk-ets-apply-for-an-emissions-monitoring-plan-emp